If you’re trying to fill that piggy bank, it might be best to steer clear of the Golden State. California is No. 2 in the United States for bankruptcy living on savings alone, according to Consumer Affairs.

The consumer platform reports that it would take the average Californian 64.4 days to go bankrupt living off their savings alone. This figure was arrived at by taking the average amount of money Americans have in savings ($9,647) and calculating how quickly it would be spent while paying the mortgage or rent, utilities, gas and food, based on survey data.

Hawaii runs out of cash even faster at 62.5 days. Washington, D.C. rounds out the top 10. (72.1 days, technically not a US state), Massachusetts (73.6 days), New Jersey (74.8 days), Connecticut (76.3 days), Maryland (77.9 days), Washington (79 days) ), New York (79.9 days) and Colorado (80.8 days).

So where should you go if you’ve just lost your job or happen to only have $9,647 to live on?

In Wyoming, you can do it in 109.7 days. Rounding out the state of equality are Arkansas (109.6 days), South Dakota (109.3 days), North Dakota (108.6 days), Montana (107.3 days) and Iowa (104.8 days), Kansas (104 .4 days), West Virginia (103.9) days), Wisconsin (103.0 days), Ohio (102.9 days).

On average, Americans can last 91 days before going bankrupt without paying the most basic expenses.

Taking basic monthly expenses into account, Consumer Affairs also calculates that you’d go bankrupt in less time with unexpected expenses, such as an emergency room visit (62.7 days on average for Americans), a car battery replacement (85.7 days) or a tow truck. service (86.8 days).

Entering your zip code, monthly costs and total savings into a widget on their site will help you localize a personal response.

The answers shouldn’t come as a complete surprise, with the Golden State ranking No. 4 out of the 50 states plus the District of Columbia in the cost of living metric. It’s cheaper than New York (No. 3), the District of Columbia (No. 2) and Hawaii (No. 1).

According to the Missouri Center for Economic Research and Information, Hawaii is so expensive because of high taxes, zoning regulations and the Merchant Marine Act of 1920, which requires all goods going between US ports to be on US ships.

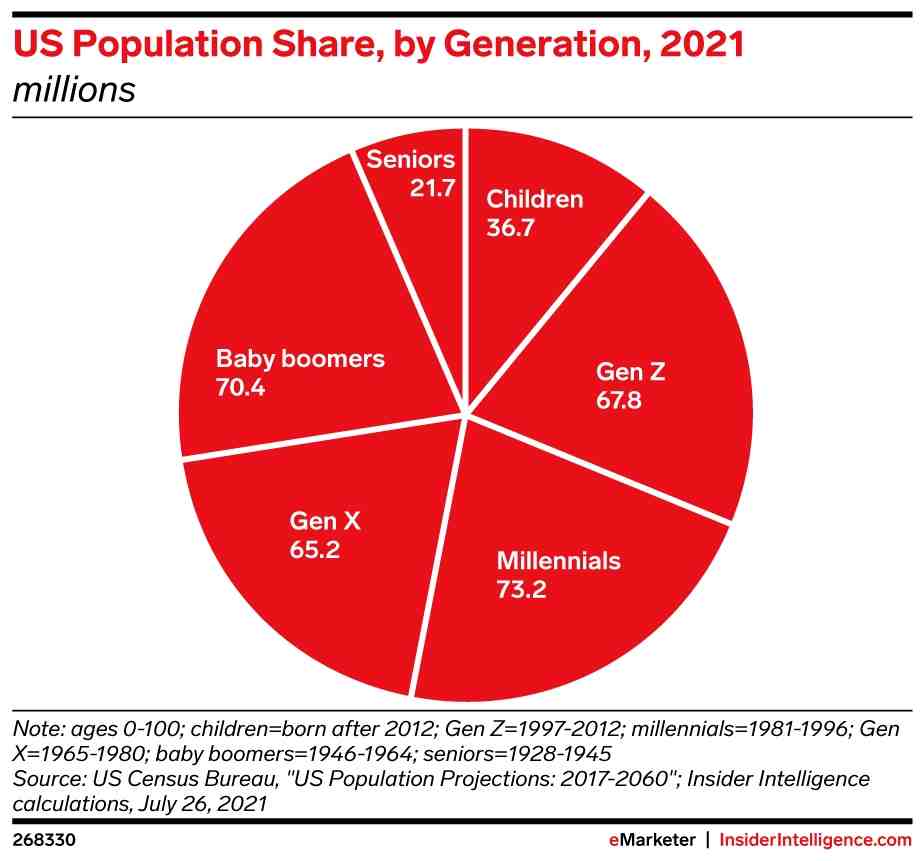

Millennials have more savings than Gen X

Conversely, members of the millennial generation have higher overall savings ($9,900) than members of the previous generation, Generation X ($9,400), according to the Consumer Affairs survey. However, that doesn’t count retirement savings, for which Gen Xers have an average of $50,500 compared to $28,100 for millennials.

The biggest generational gap is between Generation Z, which follows Millennials, and Baby Boomers, which precede Generation X. Generation Z has an average of $3,400 in savings and $12,300 saved for retirement, while Boomers have $10,200 in savings and $52,500 saved for retirement. pension.

Key operations. There are numerous methods for reducing the US national debt that go beyond simply raising taxes and cutting discretionary spending. One of the most controversial would be the opening of national borders for immigration, entrepreneurship and consumption.

Is it a good idea to move to California?

Depending on your lifestyle preferences and budget constraints (or lack thereof), you may find that it’s still worth it to live in a city with a higher cost of living. Some reasons: better job opportunities, a greater choice of public and private schools, or easier public transportation systems.

Will I be happier if I move to California? Practicality aside, it turns out that moving to California probably won’t make anyone happier. The problem lies in the word itself. According to Nobel Prize-winning psychologist Daniel Kahneman, there are two different ways of looking at well-being: current mood and general satisfaction.

Is living in California a good idea?

Talk to a Californian about what it’s like to live there and they’ll likely point out three things first: the weather, the food, and the laid-back, laid-back culture. California’s location and topography mean that much of the state, especially along the coast, has remarkably consistent warm weather throughout the year.

What is the benefit of living in California?

High Quality of Life Healthy Living: Fresh, healthy food plus plenty of outdoor activities means access to healthy options in California. What is that? Lifestyle: Pleasant weather and access to the ocean in this state. Also, mountains and other entertainment options.

Is California still a desirable place to live?

The answer is simple; California is still a very attractive place to live for many people. And those “many people” are often quite high-income individuals. As a media reader, I am aware of the many problems with governance in California.

Why you shouldn’t move to California?

We have to pay tax on petrol, water, smog, luxury tax, food, signage, hidden taxes and so on. I hope I gave you solid reasons not to live in California. California has the highest tax rate which is 7.25% and this is also added to other county taxes which is almost 8.25%.

Why should you not live in California?

One of the downsides of living in California is the higher taxes. California’s taxes are higher than average compared to other US states. As of 2019, the state of California issued a statewide tax rate of 7.25%. Different jurisdictions also add district taxes that increase this total tax rate.

Why people are leaving California?

Various factors contribute to the decision to relocate. The leading factor is cost – it’s far more expensive to live in California than other places, and many have decided they can’t or won’t pay the premium to live in this state. Housing is, of course, at the top of the list of expenses.

Is there any reason to move to California?

Plenty of Adventures Besides the beautiful beaches, California’s landscape is very distinctive. There are mountains and beautiful valleys, lakes and enchanting deserts, all waiting to be explored. An adventure in California is one you are sure to enjoy. Cities are just as exciting.

Is California still a desirable place to live?

The answer is simple; California is still a very attractive place to live for many people. And those “many people” are often quite high-income individuals. As a media reader, I am aware of the many problems with governance in California.

Is living in California worth it?

Better Quality of Life – Overall, living in California is a positive experience for most. If you’re willing to put up with the higher cost of living and pay a few extra 100k on a house, then the lifestyle in the golden state surpasses that of many other places in the world.

Which us state has the highest debt?

Countries with the highest debt

- New York. New York has the highest debt of any state, with a total debt of over $203.77 billion. …

- New Jersey. New Jersey has the second highest amount of debt in the country. …

- Illinois. …

- Massachusetts. …

- 5. California.

Which US state has the least debt? States with the Least Debt in 2020 Alaska ranks first, with a low debt ratio of just 14.2%. Its total liabilities are only $12.65 billion compared to total assets of approximately $89.17 billion in 2019.

How much is each state in debt?

| state | National debt | Gross national product |

|---|---|---|

| California | 146.7 dollars | 3571.7 dollars |

| Colorado | 22.3 dollars | 445.7 dollars |

| Connecticut | 41.3 dollars | 308.1 dollars |

| Delaware | 5.3 dollars | 83.6 dollars |

Which state has the most debt?

In 2019, the state of California had about US$506.66 billion in outstanding debt, the most of any other state.

Who Holds Largest US debt?

Of the total 7.55 trillion held by foreign countries, Japan and mainland China held the largest portions. China held US$1.05 trillion in US securities. Japan was worth US$1.3 trillion. Other foreign holders were oil exporting countries and Caribbean banking centers.

Who owes the U.S. debt?

The public holds over $22 trillion in national debt. 3 Foreign governments hold much of the public debt, while the rest is owned by US banks and investors, the Federal Reserve, state and local governments, mutual funds, pension funds, insurance companies and savings bond holders.

How much is each state in debt?

| state | National debt | Gross national product |

|---|---|---|

| California | 146.7 dollars | 3571.7 dollars |

| Colorado | 22.3 dollars | 445.7 dollars |

| Connecticut | 41.3 dollars | 308.1 dollars |

| Delaware | 5.3 dollars | 83.6 dollars |

Which country has the most debt? In 2019, the state of California had about US$506.66 billion in outstanding debt, the most of any other state.

Why is California in so much debt?

California has nearly $20 billion in debt due to a surge in unemployment claims during the pandemic, more than any other state. One reason is California’s higher unemployment rate; another is that employer taxes have not kept up with the increase in benefits.

Which country has the highest debt per capita? In 2019, New York State had a debt of about US$18,410.53 per capita, the most of any state in the US. You can see the total debt that the US collects annually here.

How much debt does California have?

In fiscal year 2021, California’s national debt was about US$143.73 billion. By fiscal year 2027, this is expected to increase to around US$188.54 billion.